The GST Reforms 2025 are set to reshape India’s taxation system, making it simpler and more consumer-friendly. At its 56th GST Council Meeting, chaired by Union Finance Minister Nirmala Sitharaman, the government announced a streamlined GST structure that impacts essentials, automobiles, services, and luxury goods. These reforms, also known as Next Gen GST Reforms 2025, will be effective from September 22, 2025.

Popcorn Tax Debate Finally Resolved

One of the quirkiest debates – how popcorn should be taxed – has finally been resolved under GST Reforms 2025. Earlier, loose salted popcorn was taxed at 5%, packaged at 12%, and caramel at 18%. Now, the system is simplified:

- Salted or spiced popcorn – 5% GST (loose or packaged)

- Caramel popcorn – 18% GST (classified under confectionery)

This clarity ensures that the only deciding factor is sugar content, benefiting both cinema-goers and retailers.

Major GST Reforms 2025: Key Highlights

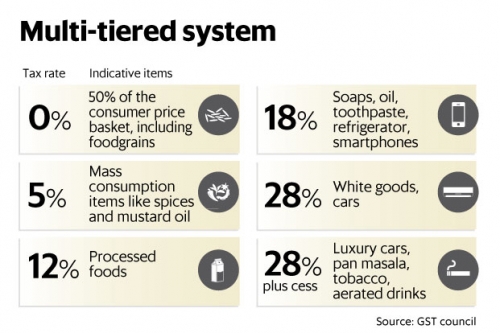

1. From Four Slabs to Two

The earlier slabs of 5%, 12%, 18%, and 28% are now reduced tojust two – 5% and 18%.

2. Relief for Everyday Essentials

Products like milk, paneer, butter, cheese, biscuits, juices, dry fruits, and even cream buns now fall under the 5% or zero-tax category.

3. Services Get Cheaper

Gyms, salons, yoga centres, and barbers now attract only 5% GST instead of 18%.

4. Big Relief for Insurance

Health and life insurance policies are exempted from GST, making them more affordable for the middle class.

5. Automobile Sector Boost

GST on small cars, two-wheelers (under 350cc), buses, trucks, ambulances, and EVs has been slashed from 28% to 18%, boosting auto stocks like Maruti Suzuki, Tata Motors, and Bajaj Auto.

6. New 40% Special Rate for Luxury & Sin Goods

A new 40% GST slab has been introduced for luxury and harmful products like tobacco, caffeinated drinks, big motorcycles, yachts, private jets, and online gambling platforms.

Market & Consumer Impact

Stock markets responded positively to the announcement. Automobile stocks hit an 11-month high, while even tobacco stocks rose despite the steep 40% GST, as analysts expect consumption demand to remain stable.

For consumers, these reforms translate to cheaper cars, two-wheelers, insurance policies, bakery items, and services. However, luxury lovers and those indulging in tobacco or sugary drinks will pay more under the new slab.

Why GST 2.0 Matters

The GST 2.0 reforms mark a big shift in India’s taxation framework. By cutting down slabs, the government aims to make the system simpler, predictable, and growth-friendly. Economists believe the move will boost compliance, ease consumer burden, and support sectors like automobiles, FMCG, and insurance.

Final Word

The New GST Rate List 2025 is designed to bring clarity and relief to everyday taxpayers while ensuring higher taxes on harmful and luxury products. From popcorn buckets to car showrooms, the effects will be visible across industries.

As the new slabs kick in on September 22, 2025, consumers can look forward to more savings, while businesses can expect simplified compliance under Next Gen GST Reforms.

Follow the live updates here:

One thought on “GST Reforms 2025: Popcorn Tax, Cars, Insurance & Everyday Goods Get Relief”